Introduction

The global wealth-management industry is under intense pressure. High-net-worth individuals (HNWIs) are no longer satisfied with templated financial plans, delayed onboarding, or generic investment products. They expect instant, personalised, and trusted advice delivered with the same seamless experience they receive from consumer-tech leaders.

Yet most banks and wealth institutions still rely on outdated processes: spreadsheets, manual data collection, and lengthy compliance reviews. This disconnect has created an opening for digital-first competitors, who are capturing wallet share with AI-powered onboarding journeys and hyper-personalised portfolios.

This report introduces Investifai, an Agentic AI Wealth-Planning Platform that orchestrates data, dialogue, and compliance in real time. It is not simply a technology upgrade—it is a strategic lever to transform productivity, strengthen client trust, and unlock measurable economic value.

The Problem We’re Solving

Wealth planning is riddled with inefficiencies and risks that erode value for both institutions and clients:

Latency & Fragmentation – Client data is scattered across legacy systems, requiring 14–20 hours of adviser effort per client. Onboarding drags across two to three weeks, damaging first impressions.

Compliance Complexity – Regulatory requirements differ across markets, yet most platforms lack built-in compliance intelligence. This exposes institutions to fines, errors, and reputational damage.

Capacity Limits – Human advisers can serve only ~150 clients annually, a model that cannot keep pace with rising demand for highly personalized services.

The result is a widening performance gap between incumbents and digital-native challengers. If not addressed, institutions risk losing their most profitable clients, especially younger HNWIs who expect real-time, digital-first interactions.

Value Proposition

Investifai delivers measurable impact across revenue, cost, and risk dimensions:

+70% Faster Onboarding – Conversational intake agents auto-capture KYC and financial goals, reducing onboarding from weeks to minutes.

35–50% Productivity Gains – Autonomous planning agents generate adviser-ready recommendations, freeing human talent for relationship building.

+50% Accuracy in Personalisation – AI fine-tuned on financial datasets generates bespoke, goal-oriented plans, improving client satisfaction and trust.

$400K–$600K Annual Value per Institution – Driven by faster asset-under-management (AUM) growth, reduced compliance rework, and lower attrition.

Unlike generic chatbots or static planning software, Investifai embeds compliance logic, multilingual dialogue, and modular APIs—transforming regulatory obligations into a competitive trust asset.

Proposed Solution: How it Works

Investifai’s architecture is designed for security, explainability, and scalability, structured into five integrated layers:

1. Client Engagement Layer

Web, mobile, and messaging interfaces powered by a multilingual AI chat hub.

Supports conversational onboarding, secure KYC capture, and goal-setting in multiple languages.

2. Agent Orchestration Layer

A supervisor agent coordinates specialized agents for document parsing, risk profiling, compliance validation, plan composition, and adviser coaching.

Tasks are event-driven and modular, ensuring scalability and traceability.

3. Knowledge & Retrieval Layer

A vector database with retrieval-augmented generation (RAG) grounds responses in regulatory texts, product catalogs, and market data.

RAG does not score risk directly—it retrieves the relevant policy or benchmark, while scoring is performed by governed models and rules.

Every recommendation is accompanied by citations for auditability.

4. Data Integration Layer

Secure, API-first pipelines connect CRM, banking systems, and open-banking feeds.

Role-based access controls and encryption protect sensitive client data.

5. Governance Layer

Live dashboards monitor bias, drift, and compliance.

An Evidence Vault stores model cards, lineage diagrams, and audit logs in tamper-proof form for regulators.

Built-in kill-switch and bias-audit workflows ensure regulatory alignment.

Differentiator

Unlike generic planning software, Investifai delivers adviser-ready recommendations in under 15 minutes, with embedded compliance and transparent explanations—redefining the client experience.

Operational Impact

Metric | Before | After | Impact |

|---|---|---|---|

Onboarding Time | 18 business days | < 0.5 day | -97% cycle-time reduction |

Strategy Turnaround | 5–7 days | < 15 minutes | Instant personalized planning |

Adviser Capacity | 15–20 clients/mo | 25–30 clients/mo | +40% productivity |

Compliance Accuracy | ~75% | 95% | +20pp improvement |

Client Satisfaction | 63% retention | 80% retention | +17pp loyalty gain |

Annual Value Uplift | – | $400K+ per bank | Faster AUM growth, lower costs |

Beyond operational efficiencies, Investifai becomes a strategic asset: accelerating inflows, lowering compliance risk, and embedding trust at scale.

Market Snapshot

The wealth-management industry is at a tipping point, shaped by three converging forces: shifting client expectations, rapid AI adoption, and intensifying regulatory scrutiny.

AI Spending Surge: IDC projects that global AI spend will surpass $631 billion by 2028, with banking and financial services representing one of the fastest-growing segments at a 27–30% CAGR【IDC†source】. Within the sector, onboarding and advisory automation rank among the top three AI use cases, underscoring the urgency for speed, personalization, and scale.

Fintech Disruption: Challenger wealthtechs are compressing onboarding cycles from weeks to days, winning younger HNWIs with digital-first experiences. Yet regulatory maturity remains a weakness. PwC research shows that a majority of fintechs still face unresolved risk and audit gaps, limiting their ability to serve institutional wealth managers at scale【PwC†source】.

Tech Major Entry: Cloud hyperscalers and big tech players offer configurable AI APIs that deliver speed and infrastructure reliability. However, they lack domain-specific orchestration, falling short in embedding regulatory nuance, financial-planning logic, and adviser workflows. The result is a toolkit—powerful but incomplete—not a turnkey solution.

Client Expectations Rising: Millennials and Gen Z will inherit more than $84 trillion in global wealth by 2045, with $72.6 trillion flowing directly to heirs【Cerulli†source】. This cohort expects hyper-personalized, multilingual, and transparent wealth experiences, with trust embedded into every interaction.

Gap & Opportunity: Investifai fills the white space between fast-moving fintechs and infrastructure-heavy tech majors. By combining enterprise reliability (audit-ready compliance, integration with legacy systems) with domain depth (goal-based planning, risk profiling, adviser coaching), it enables institutions to transform compliance from a regulatory burden into a competitive trust asset. This positions adopters not just as digital leaders, but as digital-trust leaders—a decisive differentiator in markets where regulatory reputation shapes client loyalty.

Recommendation: Hybrid Model

A pure “buy” risks vendor lock-in; a pure “build” delays impact. Investifai recommends a hybrid strategy that balances speed with control:

Commercial AI APIs for rapid deployment and proven infrastructure.

Open-source vector databases to secure data sovereignty and avoid lock-in.

Proprietary orchestration IP to embed compliance, personalization, and long-term differentiation.

This model delivers immediate ROI through faster onboarding and advisor productivity, while building a sustainable moat around compliance and trust.

Roadmap

Investifai’s rollout follows a phased approach—but with ORG 3.0 baked in to ensure agility, accountability, and learning at every stage.

Q3 2025 – Assessment (Foundations): Form cross-functional AI Pods combining wealth advisers, compliance officers, and tech leads. Establish the governance charter, baseline KPIs, and readiness scans—creating shared ownership instead of siloed planning.

Q4 2025 – Pilot (Empowered Pods): Deploy Investifai for private-banking desks under a product owner model, with each Pod accountable for outcomes like onboarding time and compliance accuracy. Human-in-loop validation ensures trust and adoption.

H1 2026 – Scale-Up (Value Stream Tribes): Expand Pods into Value Stream Tribes aligned to wealth products (e.g., estate planning, portfolio advisory, cross-border services). Tribes integrate CRM and core systems, operating with real-time dashboards and cost-to-value metrics.

H2 2026+ – Continuous Evolution (Learning Loops): Institutionalize continuous feedback loops—quarterly retraining, bias audits, and client-experience monitoring. Compliance telemetry evolves from static reviews to adaptive policy monitoring, keeping institutions regulator-ready.

This approach transforms Investifai from a project into a living capability—distributing authority, aligning teams to outcomes, and embedding learning into everyday operations.

Host Partner Targets

Investifai is best positioned to serve:

Global banks modernising their wealth platforms.

Regional banks and family offices seeking digital-first solutions for HNWIs.

Insurance and estate firms requiring AI-driven document handling.

Wealthtech providers embedding intelligence into existing platforms

Join Us

The future of wealth management is agentic, personalized, and AI-driven.

Financial institutions: Partner with us to pilot and scale Investifai.

Technology providers: Co-develop integrations and accelerators.

Investors: Back a scalable platform defining the next decade of financial services.

📩 Contact us at [email protected] or book a discovery call to explore partnership opportunities.

About the Authors

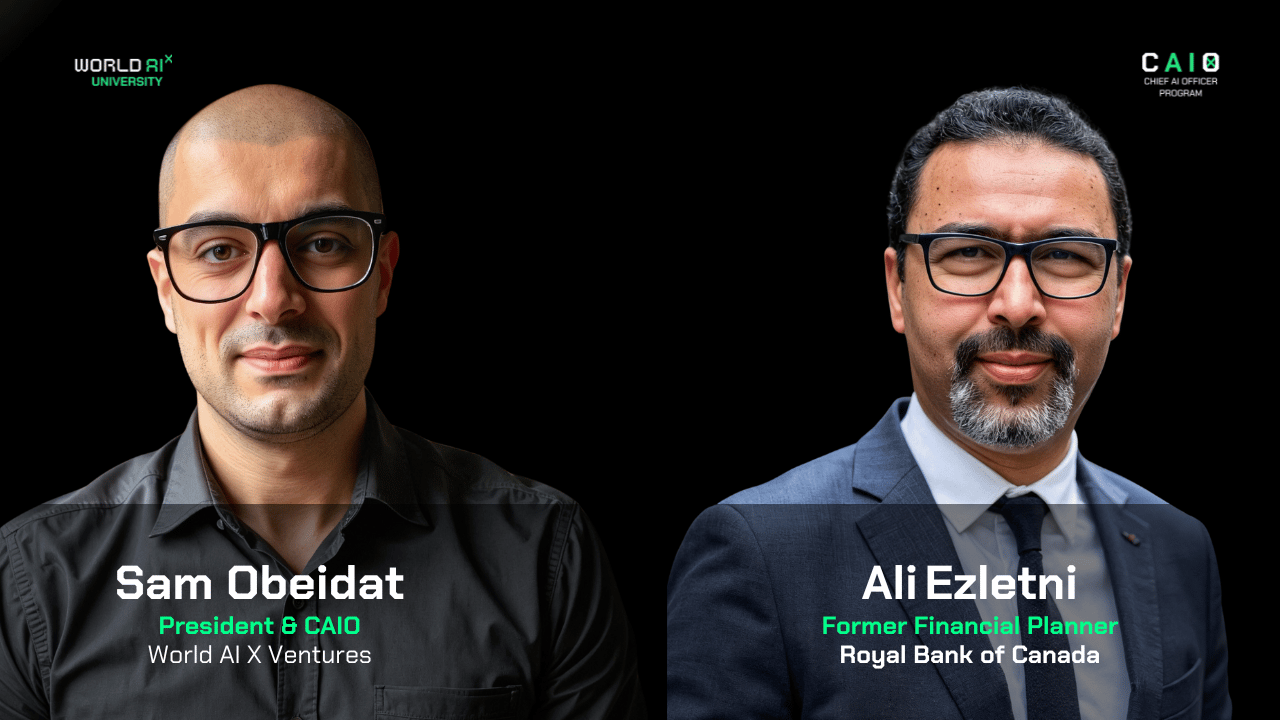

Sam Obeidat is a senior AI strategist, venture builder, and product leader with over 15 years of global experience. He has led AI transformations across 40+ organizations in 12+ sectors, including defense, aerospace, finance, healthcare, and government. As President of World AI X, a global corporate venture studio, Sam works with top executives and domain experts to co-develop high-impact AI use cases, validate them with host partners, and pilot them with investor backing—turning bold ideas into scalable ventures. Under his leadership, World AI X has launched ventures now valued at over $100 million, spanning sectors like defense tech, hedge funds, and education. Sam combines deep technical fluency with real-world execution. He’s built enterprise-grade AI systems from the ground up and developed proprietary frameworks that trigger KPIs, reduce costs, unlock revenue, and turn traditional organizations into AI-native leaders. He’s also the host of the Chief AI Officer (CAIO) Program, an executive training initiative empowering leaders to drive responsible AI transformation at scale.

Ali Ezletni is a seasoned financial planning executive with 25+ years of leadership in wealth management, investment strategies, and holistic financial planning. Most recently, he served as a Financial Planner at RBC Financial Planning for over a decade, where he advised high-net-worth individuals, families, and professional corporations on building long-term financial confidence. Earlier in his career, he spent 14 years as a Certified Financial Planner at Coast Capital Savings, where he developed deep expertise in client portfolio management, risk planning, and multi-generational wealth strategies.

Renowned for translating financial complexity into clear, actionable strategies, Ali combines disciplined analysis with a client-centric approach that prioritises trust and long-term value creation. Over the course of his career, he has helped hundreds of clients achieve clarity on retirement, estate planning, and wealth preservation. Today, Ali continues to shape the future of financial planning by applying his expertise to the intersection of advisory services and advanced AI, championing innovation while staying grounded in the human relationships that drive enduring financial success.

Sponsored by World AI X

The CAIO Program

Preparing Executives to Shape the Future of their Industries and Organizations

World AI X is excited to extend a special invitation for executives and visionary leaders to join our Chief AI Officer (CAIO) program! This is a unique opportunity to become a future AI leader or a CAIO in your field.

During a transformative, live 6-week journey, you'll participate in a hands-on simulation to develop a detailed AI strategy or project plan tailored to a specific use case of your choice. You'll receive personalized training and coaching from the top industry experts who have successfully led AI transformations in your field. They will guide you through the process and share valuable insights to help you achieve success.

By enrolling in the program, candidates can attend any of the upcoming cohorts over the next 12 months, allowing multiple opportunities for learning and growth.

We’d love to help you take this next step in your career.

About The AI CAIO Hub - by World AI X

The CAIO Hub is an exclusive space designed for executives from all sectors to stay ahead in the rapidly evolving AI landscape. It serves as a central repository for high-value resources, including industry reports, expert insights, cutting-edge research, and best practices across 12+ sectors. Whether you’re looking for strategic frameworks, implementation guides, or real-world AI success stories, this hub is your go-to destination for staying informed and making data-driven decisions.

Beyond resources, The CAIO Hub is a dynamic community, providing direct access to program updates, key announcements, and curated discussions. It’s where AI leaders can connect, share knowledge, and gain exclusive access to private content that isn’t available elsewhere. From emerging AI trends to regulatory shifts and transformative use cases, this hub ensures you’re always at the forefront of AI innovation.

For advertising inquiries, feedback, or suggestions, please reach out to us at [email protected].